The 2025 Corporate Income Tax Law (“CIT Law 2025”) was passed by the National Assembly on June 14, 2025, and will officially take effect on October 1, 2025. Applicable from the 2025 corporate income tax period onward ("CIT Law 2025This new law replaces the 2008 Corporate Income Tax Law and all previous amendments, marking a significant shift in tax policy aligned with digitalization trends and the global economy.

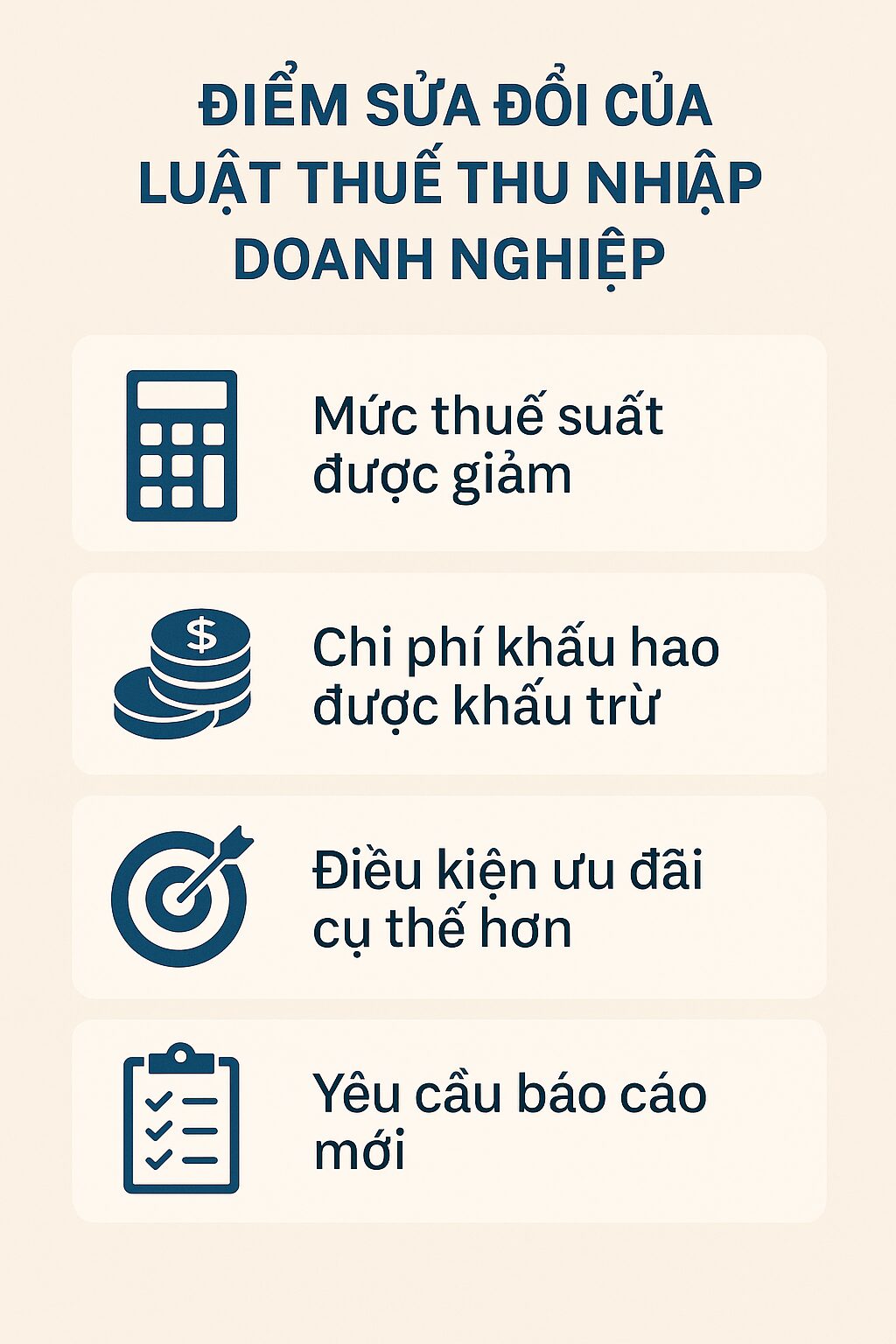

Below are the key highlights of the 2025 Corporate Income Tax Law:

Expansion of Taxable Entities

A major breakthrough of the CIT Law 2025 is the expansion of taxpayers. Accordingly, all foreign enterprises without a permanent establishment in Vietnam, but engaging in the supply of goods and services through e-commerce platforms and digital platforms in Vietnam, will be subject to corporate income tax on income generated within Vietnam.

This reform aligns with the digital economy trend, prevents tax leakage, enhances fairness within the tax system, and complies with international practices.

A notable reform point of the Corporate Income Tax Law 2025 is the flexible tax rate mechanism, designed to provide maximum support to the small and medium-sized enterprise sector. Accordingly, the common tax rate of 20% continues to apply to medium and large enterprises, ensuring stability in the tax system.

Flexible Tax Rate Structure Supporting SMEs

However, to reduce the burden on small-scale entities, the law stipulates a preferential tax rate of 15% for enterprises with total annual revenue not exceeding VND 3 billion, while applying an intermediate tax rate of 17% for those with revenue above VND 3 billion but not exceeding VND 50 billion per year.

This mechanism not only reflects the principle of fairness based on the capacity to contribute but also creates incentives to foster a startup-friendly business environment, encourage the development of local enterprises, and thereby broaden the foundation for sustainable economic growth.

New Tax Incentives Encouraging Innovation and High Technology

The 2025 Corporate Income Tax Law introduces a series of notable preferential mechanisms aimed at fostering innovation and sustainable development. Accordingly, enterprises investing in areas with particularly difficult socio-economic conditions, as well as projects in high technology, innovation, and digital transformation, are entitled to corporate income tax exemptions and reductions.

The preferential period may be extended to the maximum duration stipulated by law, and in special cases, the Prime Minister has the authority to grant an extension of up to 1.5 times the original incentive period. Notably, income derived from scientific research contracts, technology development, and digital transformation activities may be exempted from taxation for a period of up to three (3) years.

These policies clearly reflect the orientation of the Government of Vietnam in encouraging enterprises to increase investment in innovation, green transition, and sustainable growth.

Transitional Mechanism Ensuring Policy Stability

The 2025 Corporate Income Tax Law provides a special transitional mechanism to ensure stability and fairness in the implementation of tax policies. Specifically, enterprises that had already been granted incentives at the time of investment licensing are entitled to choose either to continue applying the previous incentives or to switch to the new ones, depending on their benefits and feasibility in each case.

At the same time, enterprises that meet the conditions under the new regulations, even if they were not previously eligible for incentives, will be entitled to preferential policies starting from the 2025 tax year. This provision not only helps maintain stability for investment activities but also expands opportunities for more enterprises to access preferential policies, thereby minimizing disruptions during the legal transition process.

Alignment with International Standards: Transparency and Fairness

The 2025 Corporate Income Tax Law is designed in line with global trends in tax governance, notably through the adoption of the Income Inclusion Rule (IIR). Under this mechanism, if a foreign enterprise has already paid taxes in another jurisdiction, such taxes shall be credited against its corporate income tax liability in Vietnam in accordance with domestic regulations.

This mechanism not only helps prevent double taxation but also simplifies tax obligations for multinational corporations, while reaffirming Vietnam’s commitment to complying with international standards of transparency and tax cooperation.

General Assessment

The 2025 Corporate Income Tax Law is regarded as a significant step forward in enhancing the fairness and efficiency of the tax system, particularly with its expanded scope covering digital economy enterprises, including cross-border activities. This is not only a solution to strengthen tax equity but also a safeguard for state budget revenues amid the transformation of global business models.

At the same time, the application of flexible tax rates is considered a direct tool to support small businesses, the private sector, and start-ups, thereby laying the foundation for sustainable growth. Another highlight is the preferential policy focusing on innovation, digital transformation, and high technology, which aligns with the national development orientation in the coming period as well as the commitment to advancing the green transition.

In addition, the transitional provisions are designed with clarity and transparency, ensuring both stability in the legal environment and simplified administrative procedures in line with international standards, thereby reinforcing investor and business community confidence.

With the enactment of the 2025 Corporate Income Tax Law, the demand for specialized legal support in taxation will continue to grow, especially among operating enterprises and individuals planning future business activities.

In this context, comprehensive, accurate, and well-tailored tax legal advice will be essential for taxpayers, helping them clarify new incentives and obligations, as well as how to prepare documentation and ensure compliance in a way that not only meets legal requirements but also optimizes business efficiency for entrepreneurs, household businesses, and investors intending to establish companies in Vietnam.

If your business is seeking comprehensive corporate income tax advisory solutions—from policy planning and compliance documentation to representation before tax authorities—please contact us for professional support.

Contact information

IVLF Advisors LLC

Hanoi Office

📍 Hanoi Office: R1.7 Eden Rose Urban Area, 908 Kim Giang, Thanh Liet Ward, Hanoi, Vietnam

📞 (+84) 936 726 065

✉️ info@ivlf-advisors.com